Forex CFDs are Contracts for Difference (CFDs) based on a currency pair. These financial derivatives allow traders to speculate on the price movements of currency pairs without owning any of the underlying currencies.

Forex CFDs provide traders with an efficient way to gain exposure to currency markets, offering leverage and the ability to speculate without owning the underlying assets. However, given the inherent risks, especially considering the combination of leverage and volatility, traders should use appropriate risk management techniques and ensure they fully understand the nature of the contracts they are trading- Risk management strategies, such as setting stop-loss orders, limiting leverage use, and monitoring market trends, are crucial to trading successfully in this fast-paced environment.

How Forex CFDs Work

Forex CFDs work like other CFDs. What makes them forex CFDs is the fact that the underlying is an fx pair, e.g. EUR/USD or GBP/JPY.

Forex CFD traders enter into a contract with their broker, agreeing to exchange the difference in the price of the currency pair between the time the contract is opened and closed. If the currency exchange rate moves in the direction predicted by the trader, the trader makes a profit. If not, the trader makes a loss. How large the profit/loss is will be based on how much the currency pair’s price moves relative to their position.

Key Features of Forex CFDs

The key features of forex CFDs are largely the same as for other CFDs.

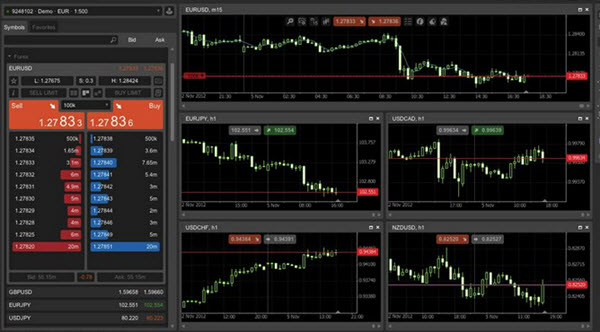

- Bid/Ask Spread

Forex CFDs involve two prices: the bid (the price at which you can sell) and the ask (the price at which you can buy). The difference between these prices is called the spread, and brokers typically make quite a lot of money from the spread. A tighter spread means lower trading costs for the trader and less profit for the broker.

- Going Long or Going Short

Forex CFDs allow traders to take both long (buy) positions if they believe the price of a currency will rise in relation to the other currency, and short (sell) positions if they believe the price will fall.

General Information About Contracts for Difference (CFDs)

- A Contract for Difference (CFD) is a financial agreement between two parties, commonly referred to as the “buyer” and the “seller”, which stipulates that the buyer will pay the seller the difference between the current value of the underlying asset and its value at the time the contract was entered into. As a CFD trader, you need to correctly predict in which direction the price of the underlying asset will go, since this will determine which type of CFD you will get (i.e. if you go long or go short).

- The first Contracts for Difference were created in the United Kingdom back in 1974 as a way to speculate on gold prices using leverage. This early version was in essence a kind of equity swap traded on margin.

- CFD trading did not become widespread until the 1990s. They were famously used in UBS Warburg´s Trafalgar House deal in the early 1990s.

- CFD trading can be a way to avoid costs associated with actually buying and selling assets. For instance, some countries have a stamp tax or similar that must be paid when company shares (stocks) are registered to a new owner. With forex CFDs, the use of derivatives can make it easier to gain exposure to some of the less frequently traded currencies.

- In the early days, it was mostly hedge funds and institutional traders that utilized CFDs. Today, CFDs are very popular among a wide range of traders, including small-scale hobby traders who like their efficiency, flexibility and leverage.

- When a broker offers CFD trading, they are also agreeing to be your counterpart in each trade. You are not trading with other traders; your broker is both your broker and your counterpart. This can create a conflict of interest.

Leverage and margin

Brokers that offer CFD trading will also offer leverage. One of the defining characteristics of CFDs, including forex CFDs, is the ability to trade with leverage, meaning you can control a larger position with a smaller capital outlay. For example, a leverage ratio of 1:30 allows a trader to control $30,000 worth of a currency pair with just $1,000 from their trading account. However, leverage magnifies both gains and losses, and will add an extra dimension of risk.

Trading with leverage requires using margin, where a portion of your funds acts as collateral for the leveraged position. If the market moves against your position, you may receive a margin call, requiring you to deposit additional funds or close your position.

In some parts of the world, including the European Union, the financial authority requires brokers to provide non-professional CFD traders with Negative Account Balance Protection. This means that you can not lose more than the money in your trading account. The broker is required to automatically close one or more of your open positions if the market moves against you too much. If your CFD trading account has Negative Account Balance Protection, it is imperative that you study exactly how it works, and then use this information when you put together your trading strategy and risk management strategy. There are situations where you would probably have decided to stay put, but with Negative Account Balance Protection, one or more of your open positions will be closed automatically.

Benefits of Trading Forex CFDs

- Access to Global Currencies: Forex CFDs provide access to trade on major, minor, and exotic currency pairs, giving traders exposure to a wide range of international markets.

- 24/5 Trading: The forex market is open 24/5 which gives traders plenty of opportunities for speculation.

- Leverage Opportunities: With the use of leverage, traders can potentially achieve greater returns compared to trading the spot forex market with just their available capital. Remember, however, that leverage will amplify both profits and losses.

- Short-Term and Long-Term Trading: Forex CFDs suit both short-term trading strategies, such as day trading or scalping, and longer-term positions.

Risks Involved

A few examples of risks that you need to be aware of:

- High Volatility: The forex market is highly liquid and volatile, meaning prices can change rapidly within a short period. This can lead to quick profits, but also large losses if the market moves against your position.

- Leverage Risk: While leverage can amplify profits, it also magnifies losses. Even small adverse price movements can lead to significant losses if you’re trading with high leverage.

- Overnight Fees: If you hold a position overnight, you may be subject to swap rates or overnight fees, which are interest payments for holding leveraged positions.

- Market Gaps: Especially during weekends or economic events, market prices can open significantly higher or lower than where they closed, potentially resulting in gaps that bypass stop-loss orders and lead to unexpected losses.

This article was last updated on: October 28, 2024